Enabling

real life

transactions

Banking

Payments

Commerce

From Digital Bank

to SuperApp

From ‘banking as we know it’ to fully charged SuperApps. People need banking, not just banks. Going digital does not mean going ‘faceless’, and ‘contactless’ does not mean being out of touch. We build your bank in the way your customers want to deal with you: a bank in their pocket, supported by agencies in their community, from tier 1 to tier GenZ.

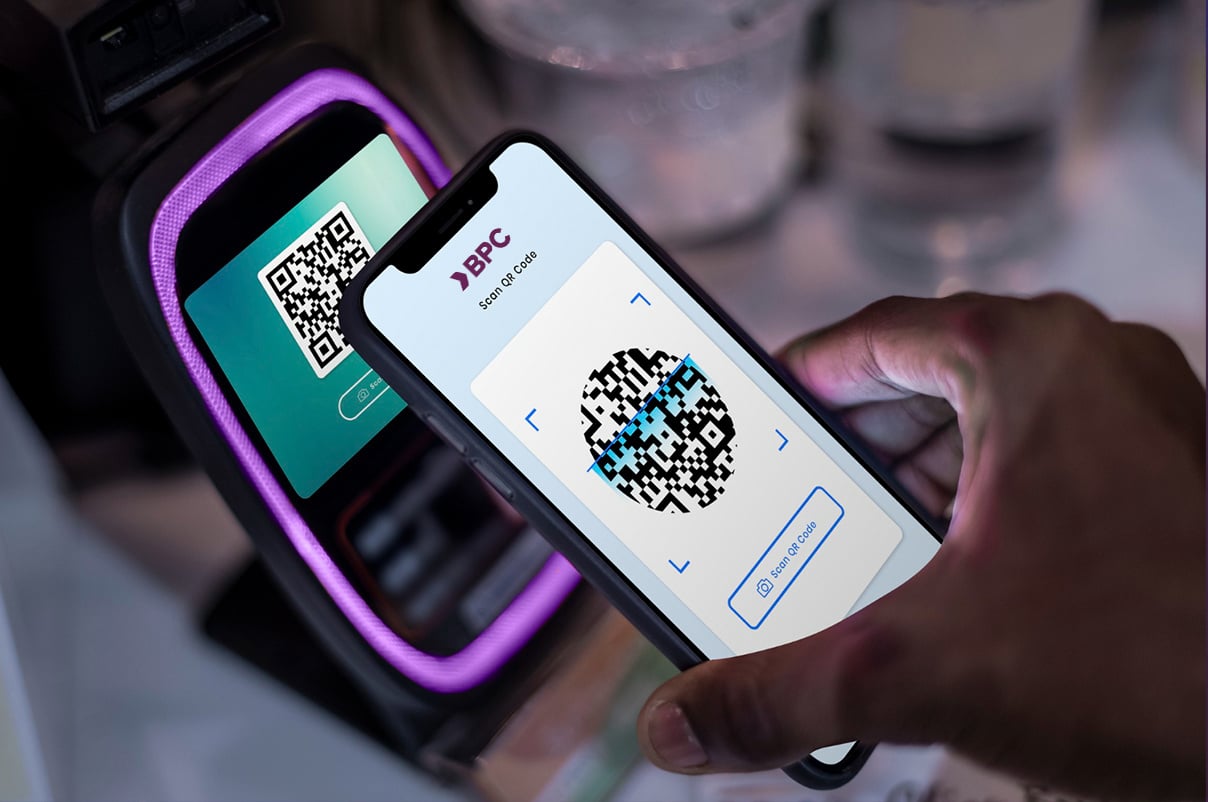

Any to any to any payments to any switch and rail

At speed levels in overdrive payment volumes increase, no longer running on closed single rails. Payment types become invisible, yet true agnosticity is still far off. In this world in motion we connect the incumbent to the new, we lay new rails for more connectivity. We build, run or service your infrastructure - your way.

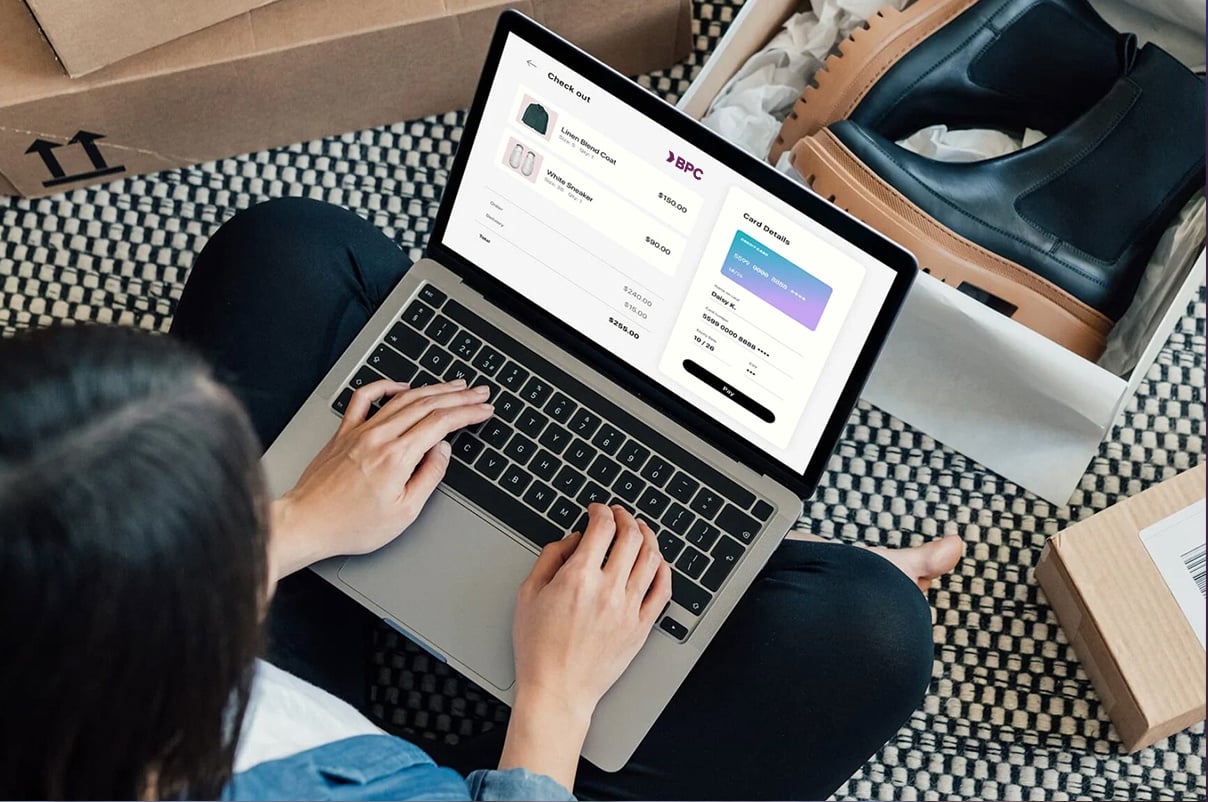

Beyond Payments and Banking: Commerce

As the world moves towards horizontal and even full circle experiences, at the heart sits the element of a transaction. Exchanges of things, values, services, assets – embedding payments and banking into a wider world of commerce, life experiences, government and more. BPC enables ‘any to any’ so you and your customers can exchange anything you value in a safe and fast manner.

From central banks

From central banks

to virtual money

in your pocket

API Banking

The SmartVista API Banking solution offers you full API management, including a developer portal, monitoring, request throttling and security.

ATM and Kiosk Management

Connecting and managing payments in the digital and the physical world can be time-consuming. Here, BPC can unburden banks and third-party processors as much as possible with SmartVista ATM Management for efficient servicing and monitoring of a diverse range of ATMs and self-service kiosks.

Marketplace

In contrast with traditional markets, a digital marketplace enables buyers and sellers of all walks of life to discover items and opportunities quickly without physically meeting at a particular time and location. This way, digital platforms facilitate greater reach and direct delivery to the buyer; faster, fresher, wider.

Digital Banking & Super Apps

Digital banking apps are reaching into targeted communities like SME banking to expats or students - and into a wider range of lifestyle services like mobility, government, leisure and others. Igniting any market with a secure relevant banking app to Super Apps fuelling fast developing markets and their demanding customers.

API Banking

ATM and Kiosk Management

Marketplace

Digital Banking & Super Apps

Enabling tomorrow’s platform economy today

What we do

As payments become embedded in a wide value chain of transactions and commerce, we power the platform economy with payments, banking, identity and mobility technology in a network with partners that add value around logistics, health, government and more. By offering a framework of collaboration and technology we build eco systems that matter in today’s world.

How we do it

Discover a world of endless possibilities with our tech platform, tailored uniquely for you. Whether you're seeking control, convenience, or a blend of both, we offer solutions to meet your every need. Dive in to explore a seamless experience powered by 30 million daily transactions. Your ambition, our technology. Embrace the future, your way.

Corner to corner

Around the world

Going digital is the global trend. But digital is as colourful and local as real life is. Culture determines use and volumes, compliance differs around the world.

We help you find the right data to build local and regional value. We work with more central banks than any other paytech company and connect you and your customers corner to corner, from the first to the very last mile, to any wallet or account.

5 Continents

5 Continents

Global presence from corner to corner, time zone to time zone.

140 Countries

140 Countries

Serving customers in over 140 countries across 5 continents.

500 Institutions

500 Institutions

Creating ecosystems with over 500 institutions.

$52 Billion

$52 Billion

52 Billion USD payment processed in 2021.

Any transaction

in any world

As the value chain around payments and banking gets embedded in real life, the amount and type of operators increases too: meet your colleagues in (neo)banking, central banks and switches, PSPs but also the fintechs, those aiming for inclusion in micro finance the transport operators and our necessary partners in government.